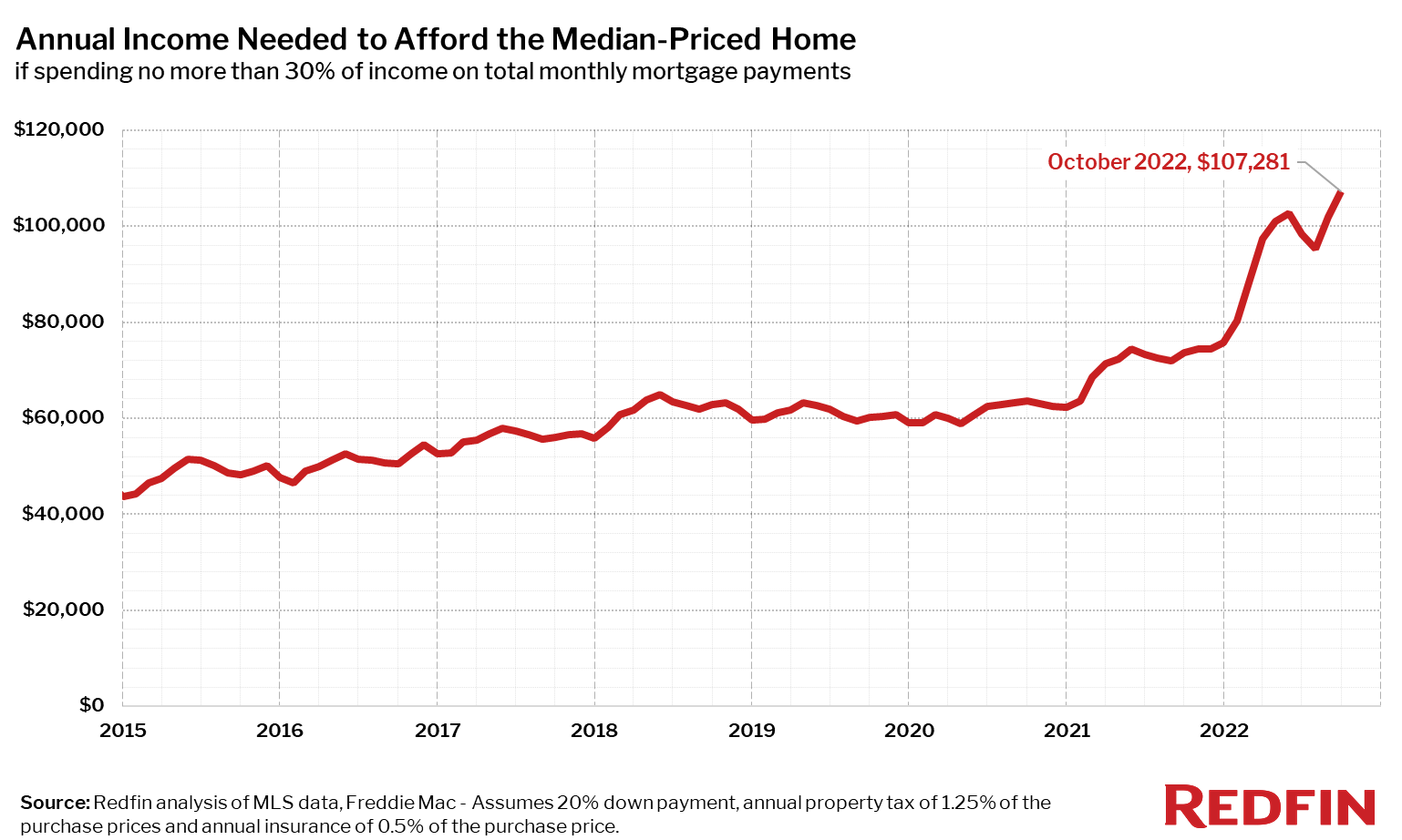

If you’re in the market for a house, you need to earn a lot more money than you did just a year ago. As in, nearly $34,000 more.

A report from Redfin found that a homebuyer must earn $107,281 to afford the average $2,682 monthly mortgage payment on a typical U.S. home. Last year, homebuyers only needed to earn $73,668.

The 45 percent increase is due to mortgage rates that have more than doubled over the last 12 months. In the same time period, the average U.S. hourly wage only grew about 5 percent, and inflation has become a beast of its own, hurting potential buyers’ budgets. To add to that, from February 2020 to October 2022, the monthly payment for an American family buying an average-priced home increased by roughly 70 percent.

According to Forbes, experts have mixed feelings about whether or not the U.S. is entering a housing bubble. Some argue that things could turn around any day, while others are worried the housing market will significantly drop within the next few years.

That doesn’t mean that people should give up on searching for a house. But, you may want to ask yourself some important questions before you step into a major financial decision.